Capital gains calculator 2021

Our capital gains tax calculator can provide your tax rate for capital gains. Taxes capital gains as income and the rate is a flat rate of 3.

2022 Real Estate Capital Gains Calculator Internal Revenue Code Simplified

The IRS assesses capital gains tax as a means of raising revenue for the government.

. The calculator computes both for 2022 and 2021. Yes No Not sure Get SARS Tax Dates and Deadlines in your Inbox. You pay 1286 at 20 tax rate on the remaining 6430 of your capital gains.

New Hampshire doesnt tax income but does tax dividends and interest. Taxes capital gains as income and the rate reaches 660. Taxes capital gains as income and the rate is a flat rate of 495.

And this other Taxable Income helps determine what tax brackets the capital gains will be in. The Schedule D form is what most people use to report capital gains and losses that result from the sale or trade of certain property during the year. Make changes to your 2021 tax return online for up to 3 years after it has been filed and accepted by the IRS through 10.

Capital gains taxes on assets held for a year or less correspond to ordinary income tax. Sale Assessment Year 2023-24 2022-23 2021-22. The capital gain tax calculator is a quick way to compute the capital gains tax for the tax years 2022 filing in 2023and 2021As you know everything you own as personal or investments- like your home land or household furnishings shares stocks or bonds- will fall under the term capital asset.

Capital Gains Tax. This is because new revised CII for indexation started getting published taking FY 2001-02 as base with value of 100. Richard October 6 2021 Staff.

Gains on the sale of collectibles rental real estate income collectibles antiques works of art and stamps are taxed at a maximum rate of 28. A good capital gains calculator like ours takes both federal and state taxation into account. If you make a.

Capital Gains Taxes on Property. Long-Term Capital Gains Tax Rates. For example if you bought a property in January 2021 and sold it in May 2021 which is less than 1 year you will have to pay short-term capital gains tax on any profits.

In most cases youll use your purchase and sale information to complete Form 8949 so you can report your gains and losses on Schedule D. So why does capital gains tax exist. The calculator computes both for 2022 and 2021.

Weve got all the 2021 and 2022 capital gains tax rates in one. Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. You pay no CGT on the first 12300 that you make.

CGT only applies on investment properties - the family home is generally exempt from CGT unless it has been rented out used to run a business or on more than two hectares of land. And length of ownership of the asset. 2022 long-term capital gains taxes can range from 0 to 20 based on your tax bracket and filing status.

For example if a person earns 50000 per year and earns a capital gain of 1000 they will have to pay 150 in capital gains taxes to the IRS. If you file jointly with your spouse on qualifying home sale capital gains the threshold exemption goes up to 500000. In case the property has been purchased before April 2001 you will need to get its fair valuation done by income tax approved valuers as of April 2001.

Capital Asset sold between April 1st. If you make a Capital Gain the most cost efficient means of calculating capital gain will then be used to calculate the capital gains tax due on the capital gain calculated. Selling an investment property or asset.

The Capital Gains Tax Calculator CGT Calculator will automatically calculate all methods relevent based on the criteria you choose in the calculator. If you want to skip out on our efficient online tax software then do this. Couples who jointly own assets can combine this allowance potentially allowing a gain of 24600 without paying any tax.

Well tell you when you need to file along with tax tips and updates. Capital Gains Tax CGT is a tax that applies in Australia when you sell an asset shares or investment at a profit. Capital Gains Calculator for Property 2021 Points to Remember.

For example If you purchased an investment property for 100000 plus 5000 in closing costs and then added 20000 in improvements over the years your cost basis would be 125000. For most people if they realize capital gains they have other income for the year as well normal wages etc. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

Use Finders quick free capital gains tax calculator to estimate your CGT costs. Idaho axes capital gains as income. Short-Term Capital Gains Tax Rates 2022 and 2021.

In 2022-23 you can make tax-free capital gains of up to 12300 the same as in 2021-22. Report your capital gains on Form 8949 Schedule D and transfer everything to Form 1040 is your best bet. Capital Gains Tax Calculator.

Capital Gains Indexation Calculator helps investors in long-term gains to save on taxes. Know about LTCG STCG assets calculation exemption how to save tax on agricultural land. The IRS uses ordinary income tax rates to tax capital gains.

Taxes capital gains as income and the rate reaches 575. You can use a capital gains tax rate table to manually calculate them as shown above. Capital gains tax CGT breakdown.

You pay 127 at 10 tax rate for the next 1270 of your capital gains. Have you disposed of an asset this year. The rate reaches 693.

In your case where capital gains from shares were 20000 and your total annual earnings were 69000. Any profit or gain that arises from the sale of a capital asset is a capital gain. Capital Gains Tax.

How to use our Capital Gains Tax Calculator. This gain is charged to tax in the year in which the transfer of the capital asset takes place. A Florida capital gains tax calculator will help you estimate and pay taxes based on your situation.

A capital gains tax is a type of tax levied on capital gains profits an investor realizes when he sells a capital asset for a price that is higher than the purchase price. Long-term capital gains taxes are more favorable than short-term capital gains taxes because they are almost certain to be taxed at a lower rate. It allows the tax payer to inflate the purchase price of the asset by considering the impact of inflation also calculate the taxable gain by considering the sale price.

Estimate capital gains losses and taxes for. The usual high-income tax suspects California New York Oregon Minnesota New Jersey and Vermont have high taxes on capital gains too. This revenue is then used to fund government programs and spending.

2022 real estate capital gains calculator gives you a fast estimate of the capital gains tax. DO I HAVE TO PAY. The difference between your Purchase Value and Sale Value is the capital gain on your investment.

SARS Capital Gains Tax Calculator Work out the Capital Gains Tax Payable on the disposal of your Asset. Your capital gains are calculated by subtracting this total cost basis from the price you sell the property for minus all closing costs like realtor or title fees. Internal Revenue Code Simplified A.

More help with capital gains calculations and tax rates.

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Tax 101

How To Calculate Capital Gains Tax H R Block

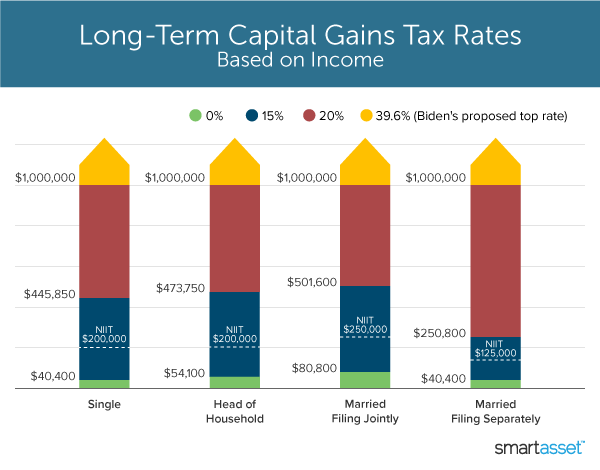

What S In Biden S Capital Gains Tax Plan Smartasset

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gains Tax Calculator The Turbotax Blog

Made A Killing With Crypto In 2021 How To Calculate Your Tax Bill

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

2021 Capital Gains Tax Rates By State

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca

Capital Gains Tax What Is It When Do You Pay It

2022 Capital Gains Tax Rates And Tips On How To Reduce What You Owe

Tax Calculator Estimate Your Income Tax For 2022 Free

Canada Capital Gains Tax Calculator 2022 Real Estate Stocks Wowa Ca